In this article, we will look at different real-time scenarios and Fintech Influencer advices to let you know how exactly you can apply the 50/30/20 Budgeting Rule to achieve the best results, we’ve also included the different approaches applied by the below Fintech Influencers to give you a holistic purview of the popular 50 30 20 rule of budgeting.

- CA Rachana Ranade

- Ankur Warikoo

- जोश Money

- Asset Yogi

- Success and Happiness

Managing finances can be a challenging task, especially for those who are new to it. With bills, loans, and expenses to pay, it can be difficult to figure out how much money to allocate toward each expense while still saving for the future.

This is where the 50 30 20 rule comes into play. Financial experts often recommend creating a spreadsheet to track income and expenses and using the 50 30 20 rule of money as a guideline for budgeting.

Hence, we’ve curated an Easy-to-Use 50/30/20 Rule Spreadsheet for you to calculate and track your expenses and save more effectively. Check the below instruction to know how use and download the 50-30-20 rule budgeting template.

What is the 50-30-20 Rule of Budgeting?

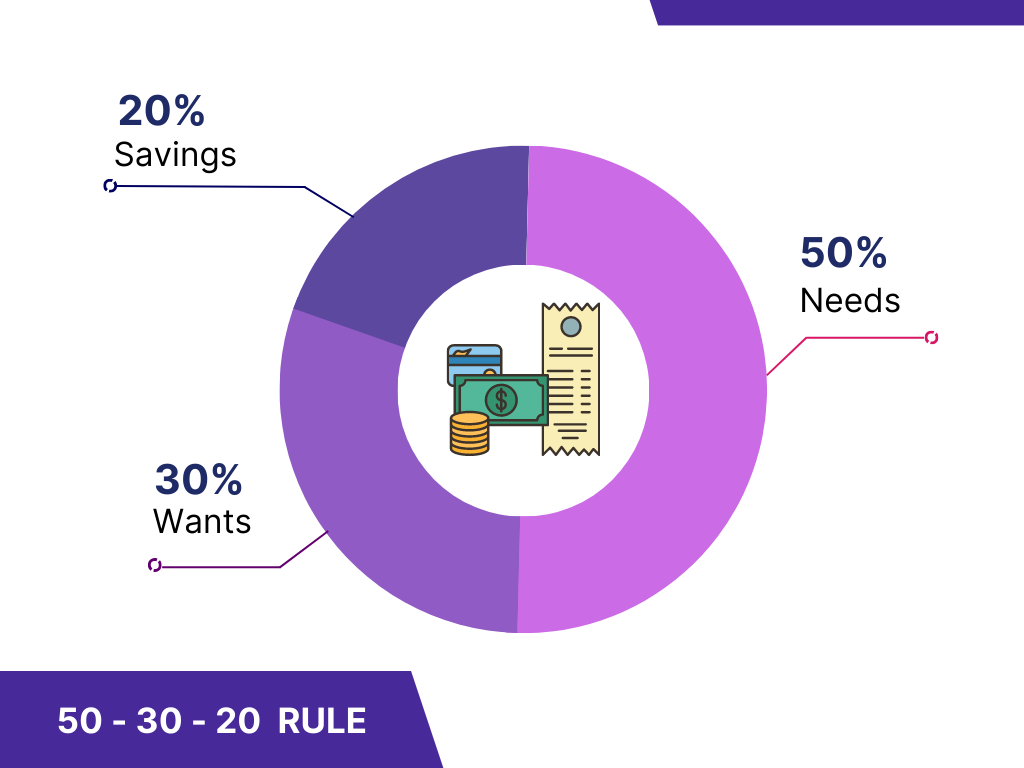

The 50 30 20 Rule of budgeting is a popular personal budgeting method popularised by Elizabeth Warren that suggests allocating your after-tax income into three spending categories, which are 50% of your income towards Needs, 30% towards Wants, and the final 20% towards Savings or paying off your debt.

By following this 50/30/20 Financial Guideline you can achieve better financial stability.

Let’s take a closer look at each component of this Rule:

Allot 50% Of Your Income Towards Basic Needs

Needs are essential expenses that are required to sustain our lives and well-being. These expenses cannot be avoided as they are vital for survival. These expenses typically include:

- Housing: Rent or mortgage payments, property taxes, and home insurance are all part of housing expenses. This is a significant expense for most people, and it is crucial to ensure that we have a safe and comfortable place to live.

- Utilities: This category includes expenses such as electricity, gas, water, and internet. These are necessary for everyday living and cannot be avoided.

- Groceries: The cost of food and other household items, such as toiletries, cleaning supplies, and personal care products, are all part of grocery expenses. These expenses are essential for our health and well-being.

- Transportation: This category includes the cost of owning or renting a vehicle, public transportation, fuel, and maintenance. Transportation is necessary to get to work, school, and other important destinations.

- Insurance: Health, life, bike, and car insurance are all essential expenses that provide protection and financial security for individuals and their families.

Set Aside 30% for Your Wants

Wants are non-essential expenses that are not required for survival but can add value and enjoyment to our lives. These expenses include:

- Dining out: Eating at restaurants or ordering takeout is a popular activity that adds convenience and variety to our meals.

- Entertainment: This category includes expenses such as movie tickets, concerts, and other recreational activities and it is a fun and enjoyable way to spend your free time, which is crucial for a healthy mind and body.

- Travel: Travelling to different places for leisure or vacation can be an enriching and fulfilling experience. However, it can also be costly but if you plan to save smartly and schedule the itineraries in advance, you can save a lot of money.

- Shopping: Purchasing items such as clothing, electronics, and other consumer goods can be an enjoyable experience, but it is not necessary for survival.

Prioritize Savings By Dedicating 20% Of Your Income

Savings or debt repayment are essential categories for financial stability and long-term planning. These expenses include:

- Retirement savings: Saving for retirement is essential to ensure a comfortable and secure future.

- Emergency fund: Having an emergency fund can help cover unexpected expenses, such as medical bills or car repairs.

- Debt repayment: Paying off debt, such as credit card balances or student loans, is an important step towards financial freedom and can free up money for savings and wants.

50 30 20 Budgeting Rule With A Practical Example.

If you have a monthly income of Rs. 50,000, you should allocate Rs. 25,000 (50%) towards your needs, Rs. 15,000 (30%) towards your wants, and Rs. 10,000 (20%) towards savings or debt repayment.

Using the 50/30/20 rule, a household with an income of Rs. 50,000 per month would allocate Rs. 7,498 (50%) towards needs, Rs. 4,499 (30%) towards wants, and Rs. 2,999 (20%) towards savings or debt repayment.

| Category | Amount Allocated | Percentage |

| Needs | Rs. 7,498 | 50% |

| Wants | Rs. 4,499 | 30% |

| Savings or Debt Repayment | Rs. 2,999 | 20% |

| Total | Rs. 14,996 | 100% |

The 50-30-20 budget rule can help individuals and households create a budget that aligns with their income and goals.

It provides a simple and straightforward approach to managing finances and ensures that essential needs are met while still allowing for some flexibility in discretionary spending.

Checkout these 5 Finance Influencers explanations on the 50 30 20 Money Budgeting rule.

1. CA Rachana Ranade – Master Your Money

CA Rachana Ranade in a recent episode of Master Your Money, She explained about the 50 30 20 rule of budgeting with a simple example. ‘Master your Money’ is a series presented by Business Insider India.

In this video, Rachana talks about how to define basic necessities using a simple formula.

According to her, if you have 100 rupees, then 50 rupees should go towards your basic necessities like food, shelter, and groceries.

The next 30 rupees should be allocated for your wants or splurging, because let’s face it, you want to enjoy your money too! After all, when will you enjoy it if not in your youth?

But, what about savings?

Well, the remaining 20 rupees should be saved for your future. And, here’s the catch – this 20% should be the first thing you set aside from your income, not what’s left after spending.

This means that if you earn 100 rupees, the first 20 rupees should be allocated towards savings, and then you can balance your remaining 80 rupees between your necessities and wants.

So, if you’re someone who struggles with managing your finances, give the 50/30/20 rule a try. It’s a simple and effective way to ensure that you’re not overspending and that you’re saving enough for your future. And, who knows, maybe you’ll finally be able to buy that iPhone you’ve been eyeing for so long!

2. Ankur Warikoo: Learn How to Budget and Save Money With 50 30 20 rule

Well, get ready to take notes because finance influencer Ankur Warikoo is here to share his knowledge about the budgeting rule 50 30 20!

According to him, The 50 30 20 rule is a great model for beginners who are just starting to earn money from freelancing or their first job.

But here’s the kicker: As you gain more experience and your income grows, the 50 30 20 money rule may not be enough to cover your long-term financial goals.

Such as retirement, education, marriage, and your kids’ education.

That’s why Ankur has come up with a new model that is personally tested and built on the power of compounding.

The new model focuses on investing a larger percentage of your income to take advantage of compounding, which means that your money will grow exponentially over time.

By following this budgeting principle, Ankur believes that you can achieve financial freedom and security in the long run.

So, whether you’re just starting out or you’re a seasoned professional, budgeting is an essential part of managing your finances.

And with Ankur’s expert advice, you can take your budgeting skills to the next level and achieve your financial goals faster than you ever thought possible.

3. Josh Money: Learn the Art of Money Management with 50 30 20 Budget Rule

Josh Money, the popular YouTube channel that’s dedicated to all things finance.

According to Josh Money, One of the most useful and successful rules of budgeting in the finance industry is the 50 30 20 rule.

By sticking to this rule, you can ensure that you’re not overspending on unnecessary things and that you’re putting away enough money for your future.

But how do you know the difference between needs and wants?

It’s simple. If you can live without buying something, then it’s a want.

If it’s something that you absolutely need to survive, like food and shelter, then it’s a need.

By prioritizing your needs and wants, you can make sure that you’re not wasting money on things that won’t bring you long-term happiness.

And here’s the best part. You don’t need to have a lot of money to become rich.

By investing just 20% of your income as per the budgeting rule 50 30 20 and letting it compound year after year, you can build a substantial amount of wealth over time.

It’s all about starting small and being consistent.

So, if you’re ready to take control of your finances and start building a better future for yourself, then head over to Josh Money’s channel and start learning the strategies of money management that can help you achieve your goals.

4. Asset Yogi: 50/30/20 Rule Is Easy Financial Plan for Beginners

Asset Yogi, the popular financial influencer, has some valuable insights on the 50 30 20 rule.

If you’re looking to become rich overnight, this may not be the solution for you. However, if you observe millionaires around you, you’ll see that many of them started as salaried employees, but became rich over a period of 20 to 25 years.

The key to their success was their financial discipline, habit of saving, researching, and investing in the right place.

The 50 30 20 rule suggests putting aside at least half of your salary into a savings account. But it’s important to note that this rule may not be applicable to everyone. You have to create a framework that is tailored to your own financial situation.

Determine what percentage of your income should be saved, what percentage can be spent on basic necessities, and what percentage can be spent on special needs.

If you’re just starting your career, the 50 30 20 rule may be a good place to start. This means you can spend 50% of your monthly income on basic needs and try to control your expenses as much as possible. For luxury expenses, aim to spend no more than 30% of your income.

It’s crucial to save at least 20% of your income for retirement planning, education, marriage, or medical emergencies.

Even if you can only afford to put aside a small amount of money each month, it will make a big difference in the long run. With experience and patience, your income will also increase.

After gaining some experience in your career, your income may triple or quadruple. At this point, it may be tempting to increase your expenses.

However, it’s still important to maintain financial discipline by continuing to save and invest. Consider increasing your savings and investment instead of increasing your expenses. By following these principles, you too can achieve financial success over time.

5. Money and Success

Money and Success, the popular financial YouTube channel, has some valuable insights on the 50 30 20 money rule.

They say that, If you’re looking to improve your financial situation and want to be able to meet all your needs without any problems.

The 50 30 20 rule is a popular way to manage your money, which divides your monthly expenses into three categories: Needs, Wants, and Savings.

Many financial experts say that the needs of your month should never exceed 50% of the income.

But if it ever happens that your needs get more than 50% then you don’t have to panic. All you have to do is carefully weigh your miscellaneous spendings.

In this way you will know where your money is going. Also by reducing the needs, you can bring your budget to the limit of 50% and when this happens means that your needs match with the budget of 50%.

The next step is to spend 30% on desires, you don’t require branded clothes to wear. You can wear non-branded clothes too, but the problem arises when people cannot differentiate between their needs and wants at all.

If this happens to you too, then just ask yourself whether you can live without the thing you want to buy or not. If the answer is no, skip the purchase.

The final step is to save your money. 20% of your earnings goes to savings. Or else it is not done. If you can add a lot of money to your savings by reducing your desires

This rule of managing money is very good for those people who have low income because in this way they can save a lot of money.

The 50 30 20 rule can prove to be very helpful for you to manage money and grow money, hopefully.

Also checkout our article on money management tips to manage your finances

Download 50 30 20 Rule Spreadsheet

We have created an easy and free downloadable 50 30 20 Rule Spreadsheet for you, Start now and Enjoy budgeting.

Calculate and Monitor your spendings easily.

How To Use 50 30 20 Rule Spreadsheet?

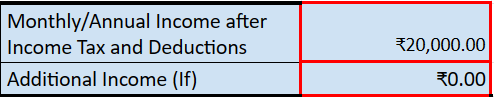

Fill up the the total monthly/annual income after the tax and deductions as shown in the picture below.

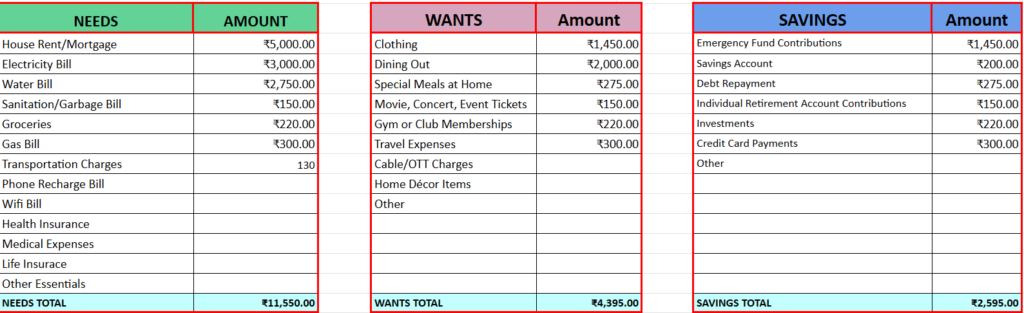

Enter the amount for each item in the Needs, Wants and Savings tables as shown below.

You will get the total of Needs, Wants and Saving.

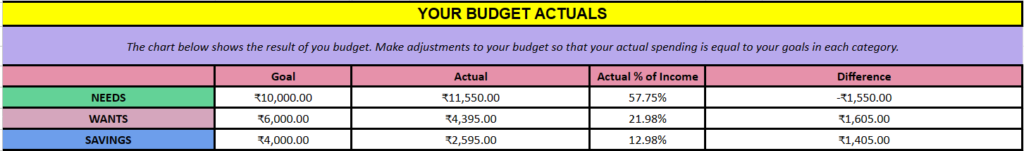

Now, you can compare the Ideal 50 30 20 Amount of your income and the actual spending of your income including the percentage of each proportion.

Frequently Asked Questions on 50-30-20 Rule:

1. Is the 50 30 20 rule useful?

The 50-30-20 rule can be a useful guideline for managing your finances, but it may not be appropriate for everyone’s individual financial situation.

The rule can be helpful as a starting point for creating a budget and getting a handle on your finances. However, it’s important to note that everyone’s financial situation is unique, and you may require to adjust the percentages based on your own income, expenses, and financial goals.

Ultimately, the key to effective financial management is to create a budget that works for your individual situation and to stick to it consistently over time.

2. What are the disadvantages of 50-30-20 rule?

The rule assumes that everyone has the same basic living expenses, such as housing and groceries, but in reality, these costs can vary widely depending on where you live.

Low-income earners may find it difficult to allocate 50% of their income towards necessities, especially if they live in an area with high living costs.

3. Does 50 30 20 rule work in India?

The 50-30-20 rule can be a helpful guideline for managing finances in India, but it should be adjusted based on individual circumstances and financial goals.

It’s essential to create a budget that works for your unique situation and to consistently track your spending and savings to ensure that you’re on track to meet your goals.

4. Is the 50/30/20 rule realistic?

The 50/30/20 rule can be a realistic guideline for some people, depending on their individual financial situation and goals.

However, it’s important to keep in mind that everyone’s circumstances are different, and there may be some situations where this rule doesn’t work as well.

Happy Budgeting!