Gold has long been regarded as a safe haven for investors during turbulent economic times, including recessions. Its historical significance as a store of value and hedge against inflation has solidified its reputation as a reliable asset. Let’s delve deeper into understanding why gold remains a sought-after investment during recessions.

Do you want to save in a 24k digital gold? Download the Jar App now.

Is Gold Safe? Historical Perspective

Throughout history, gold has maintained its value, even when other assets falter during economic downturns. Its scarcity, durability, and universal acceptance make it a tangible asset that transcends geopolitical boundaries and economic uncertainties. As fiat currencies fluctuate and stock markets experience volatility, gold often emerges as a stabilizing force, preserving wealth and purchasing power.

Purchasing Power

One of gold’s primary attributes is its ability to preserve purchasing power over time. During recessions, central banks may adopt expansionary monetary policies, leading to currency depreciation and rising inflation. In such scenarios, gold serves as a store of value, maintaining its purchasing power and offering investors a reliable refuge from depreciating currencies.

Hedge Against Inflation

Recessions often coincide with periods of inflationary pressure, eroding the value of money and diminishing purchasing power. Gold serves as a hedge against inflation, as its intrinsic value and limited supply ensure it retains its worth over extended periods. By allocating a portion of their portfolio to gold, investors can mitigate the adverse effects of inflation and safeguard their wealth.

Diversification Benefits

Incorporating gold into an investment portfolio enhances diversification, reducing overall risk exposure during recessions. While stocks, bonds, and other assets may experience significant volatility, gold’s performance tends to exhibit lower correlation with traditional financial markets. By diversifying across asset classes, investors can achieve a balanced portfolio, minimizing losses and preserving capital during economic downturns.

Liquidity and Accessibility

Gold’s liquidity and global accessibility contribute to its appeal as a safe haven asset during recessions. Unlike certain investments that may experience liquidity constraints during market downturns, gold maintains a vibrant market with robust demand. Whether through physical bullion, exchange-traded funds (ETFs), or gold-backed securities, investors can easily access and liquidate their gold holdings, ensuring financial flexibility and security.

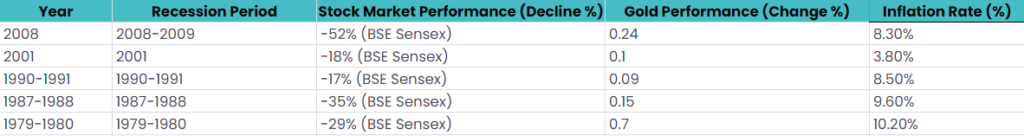

Is Gold Safe During Recession? Explained Through Data

Key Insights:

- Gold as a Safe Haven: In the context of Indian recessions, gold consistently demonstrated its role as a safe haven asset, with positive performance during periods of stock market decline.

- Inflation Dynamics: The inflation rates during these recessionary periods in India varied, highlighting gold’s utility in preserving purchasing power and mitigating the impact of rising prices.

- Portfolio Diversification: Gold’s resilience during economic downturns in India underscores its importance as a diversification tool, helping investors maintain portfolio stability and wealth preservation.

This chart offers insights into gold’s performance relative to the BSE Sensex and inflation rates during significant recession periods in India. It emphasizes gold’s role as a reliable asset class for Indian investors seeking to navigate economic uncertainties, preserve wealth, and achieve diversification in their portfolios.

Conclusion

In conclusion, gold’s safety during recessions stems from its historical resilience, store of value characteristics, inflationary hedge, diversification benefits, and liquidity. While no investment is entirely risk-free, gold’s intrinsic attributes and global recognition position it as a reliable asset class during turbulent economic times. As investors navigate the complexities of recessions and market uncertainties, allocating a portion of their portfolio to gold can provide stability, preservation of wealth, and peace of mind amidst economic volatility.

Frequently Asked Questions (FAQs) about Gold Investment during Recessions

1. Why is gold considered a safe haven during recessions?

Gold is viewed as a safe haven during recessions due to its historical role as a store of value. Amid economic uncertainties, central banks’ expansionary monetary policies, and potential currency devaluation, gold retains its intrinsic value. Investors often flock to gold as a reliable asset to preserve wealth, mitigate risks associated with volatile financial markets, and safeguard against inflationary pressures.

2. How does gold serve as a hedge against inflation during economic downturns?

Gold’s inherent properties, including its scarcity and universal acceptance, enable it to serve as a hedge against inflation. During recessions, central banks may implement measures like quantitative easing, leading to increased money supply and potential currency depreciation. As fiat currencies lose value, gold’s purchasing power remains intact, allowing investors to maintain wealth and combat the erosive effects of inflation.

3. What are the diversification benefits of incorporating gold into an investment portfolio during recessions?

Integrating gold into an investment portfolio enhances diversification benefits, particularly during recessions. Gold’s performance often exhibits a lower correlation with traditional financial assets such as stocks and bonds. By diversifying across asset classes, investors can reduce overall portfolio volatility, minimize losses, and preserve capital amidst economic downturns, thereby achieving a balanced and resilient investment strategy.

4. How can investors access and liquidate their gold holdings during recessions?

Investors can access and liquidate their gold holdings through various avenues, ensuring financial flexibility and security during recessions. Physical bullion, gold-backed ETFs, and securities offer investors diverse options to acquire and dispose of gold assets. Additionally, reputable bullion dealers, financial institutions, and online platforms facilitate gold transactions, allowing investors to capitalize on market opportunities and navigate economic uncertainties effectively.

5. Are there any risks associated with investing in gold during recessions?

While gold serves as a reliable asset during recessions, investors should be aware of potential risks associated with gold investment. Factors such as market volatility, fluctuating demand-supply dynamics, geopolitical tensions, and regulatory changes can influence gold prices and investment returns. Additionally, storage costs, liquidity constraints, and market sentiment may impact gold’s attractiveness as an investment vehicle. Therefore, conducting thorough research, assessing risk tolerance, and consulting financial advisors are essential to make informed investment decisions during recessions.